The Main Principles Of Have you claimed the Employee Retention Tax Credit?

The Best Strategy To Use For Eligible Businesses: Claim the Employee Retention Tax Credit

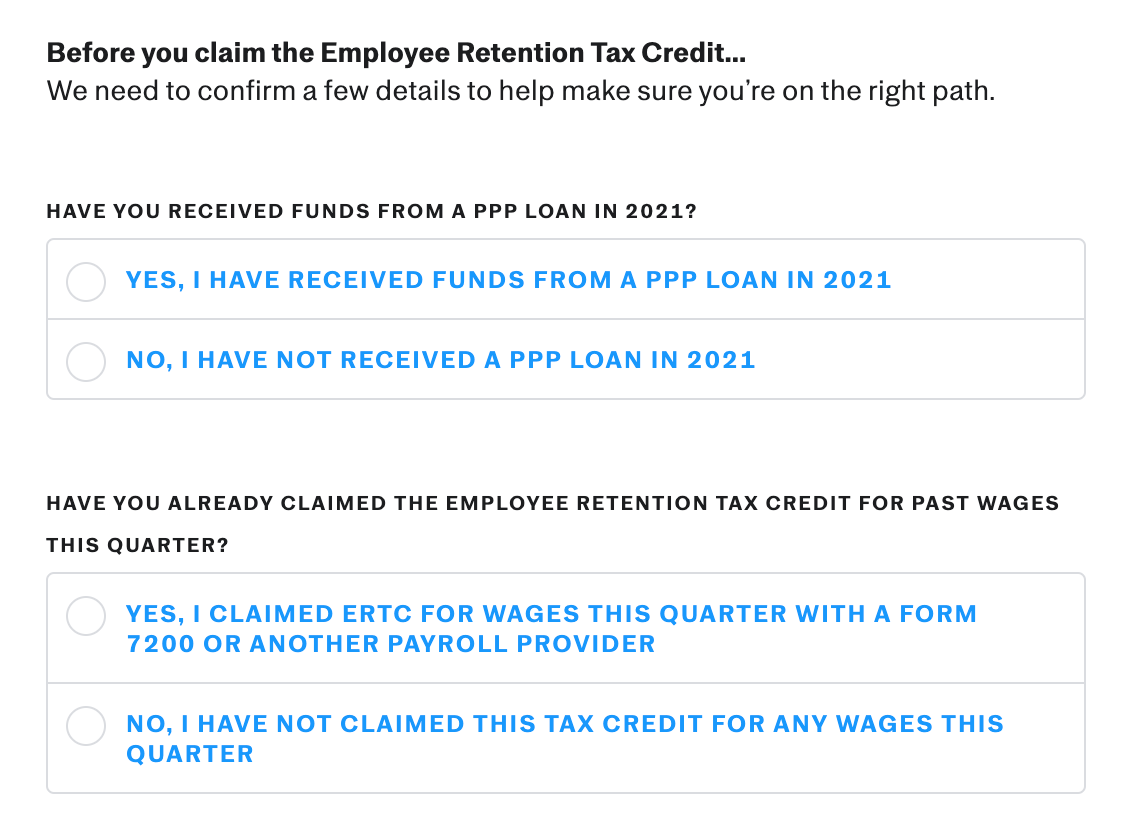

If you are an accounting specialist, do not supply your clients with the PPP Forgiveness FTE information. Also, keep in mind that if a client has actually taken and will be forgiven for a PPP loan, they may now be eligible for the worker retention credit on specific earnings. CARES Act 2020 Those who have more than 100 full-time employees can only utilize the certified wages of employees not offering services due to the fact that of suspension or decline in organization.

Generally, employers can just utilize this credit on employees who are not working. Employers with 100 or fewer full-time staff members can utilize all staff member salaries those working, as well as at any time paid not being at work with the exception of paid leave supplied under the Households First Coronavirus Reaction Act.

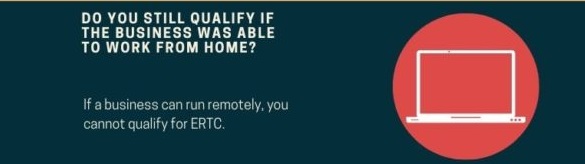

American Rescue Strategy Act 2021 This law permits particular hardest-hit businesses severely economically distressed employers to declare the credit against all employee's qualified wages instead of simply those who are not offering services. This Website struck companies are specified as employers whose gross receipts in the quarter are less than 10% of what they remained in a comparable quarter in 2019 or 2020.

Little Known Questions About There's Still Time to Claim the Employee Retention Tax Credit.

The internal revenue service does have guardrails in place to prevent wage boosts that would count toward the credit once the employer is qualified for the staff member retention credit. Are Tipped Wages Included in Qualified Wages? INTERNAL REVENUE SERVICE notification 2021-49 clarified that ideas would be consisted of in qualified earnings if these wages were subject to FICA.

Tips that quantity to less than $20 in a month are exempt FICA salaries and would not get approved for the retention credit. Are Owner/Spouse Incomes Included in Qualified Incomes? It was well understood from a previous statute and previous IRS assistance that related people to a bulk owner were not consisted of in certified wages (see IRS FAQ # 59 for specifics).

UNDER MAINTENANCE